The Union Government has revised the tax slabs under the new tax regime in its 2024-25 budget.

As per revised Tax slabs below benefits have been provided

– Income tax saving up to 17500 provided for salaried employees in the new tax regime.

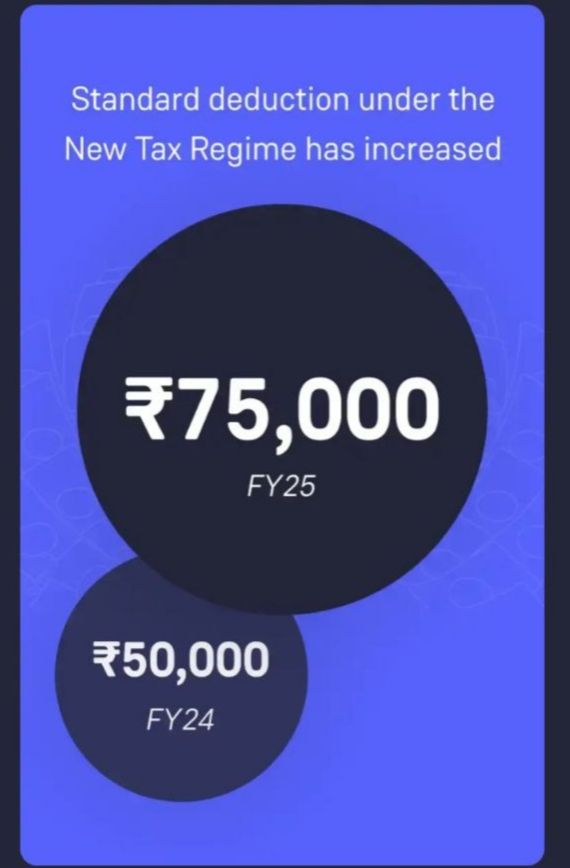

– Standard deduction for salaried employees increased from ₹50000 to ₹75000

– Deduction on family pension for pensioners to be increased from ₹15000 to ₹25000

Below are the revised tax slabs as per union budget 2024-25

| Income | New tax regime slab |

| Up to Rs 3 lakh | Nil |

| From Rs 3 lakh to Rs 6 lakh | 5% |

| From Rs 6 lakhs to Rs 9 lakh | 10% |

| From Rs 9 lakh to Rs 12 lakh | 15% |

| From Rs 12 lakhs to Rs 15 lakh | 20% |

| Above Rs 15 lakh | 30% |

| Source: Budget 2023-24 |